accumulated earnings tax irs

Accumulated Earnings and Profits EP of Controlled Foreign Corporation 1220 12032020 Form 5471 Schedule M. The characterization of the distribution is governed by Section 1368c.

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder-level tax seeSec.

. Internal Revenue Code IRC 7216 Requirements for VITATCE Partners 1120 12162020 Form 5471 Schedule E Income War Profits and Excess Profits Taxes Paid or Accrued. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2018 Form 5471 Schedule J Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2012 Form 5471 Schedule M Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons.

Accumulated Earnings Tax. Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. IRS Tax Credit Bond Rates The Special Investments Branch posts the daily rates for the following Internal Revenue Service bonds by 1000 am.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. A tax imposed by the federal government upon companies with retained earnings deemed to be unreasonable and in excess of what is considered ordinary. NW IR-6526 Washington DC 20224.

See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency includes an amount with respect to the accumulated earnings tax imposed by IRC 531 so that the burden of proof initially will be on a taxpayer. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA.

Eastern Time every federal business day. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it. Disclosure and Use of Tax Information Â.

If the rates have not been posted by 1000 am please call us.

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Cares Act Implications On Corporate Earnings And Profits E P

Irs Use Of Accumulated Earnings Tax May Increase

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

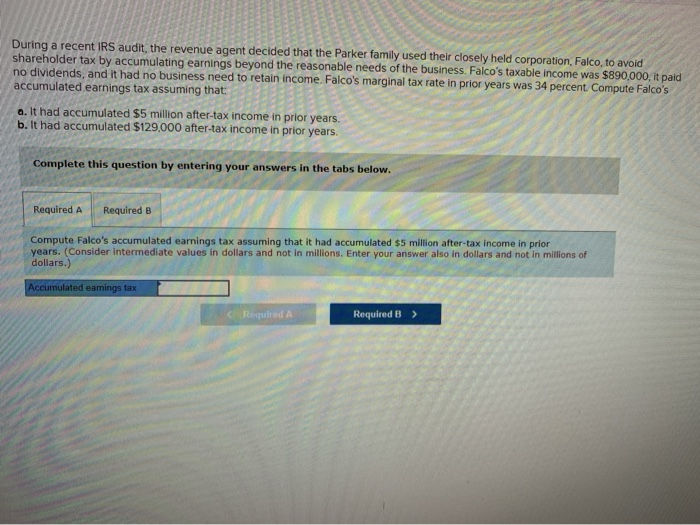

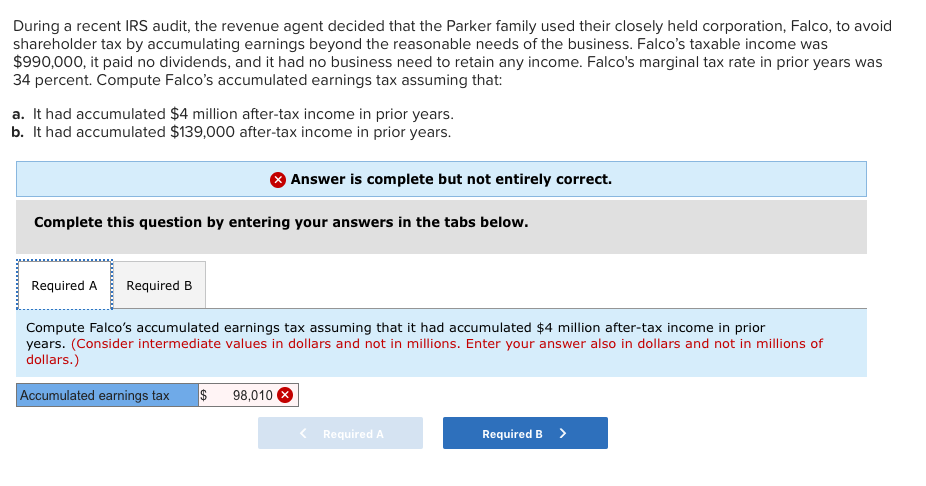

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Demystifying Irc Section 965 Math The Cpa Journal

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

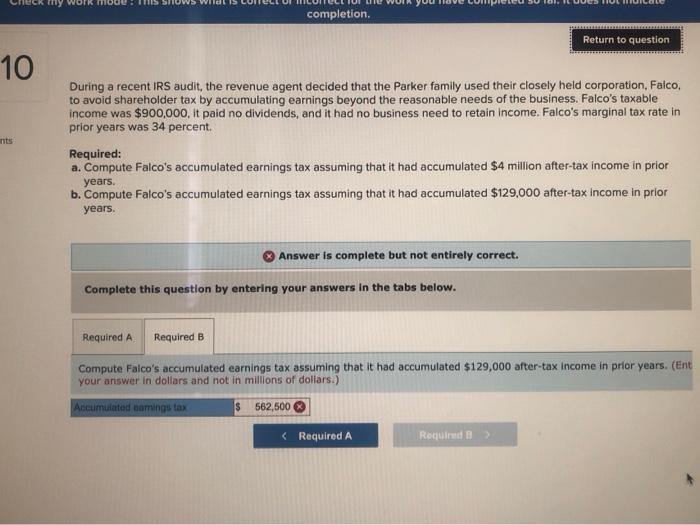

Solved Completion Return To Question 10 During A Recent Irs Chegg Com

Earnings And Profits Computation Case Study

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

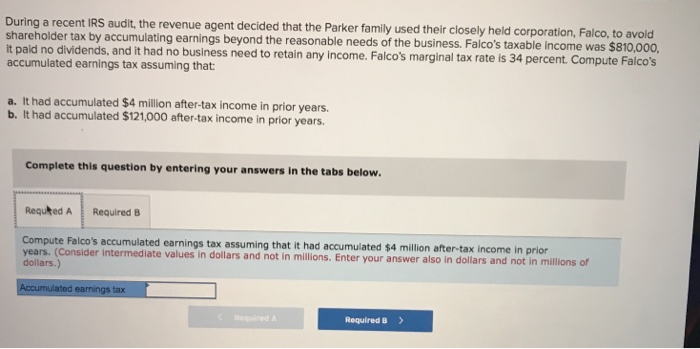

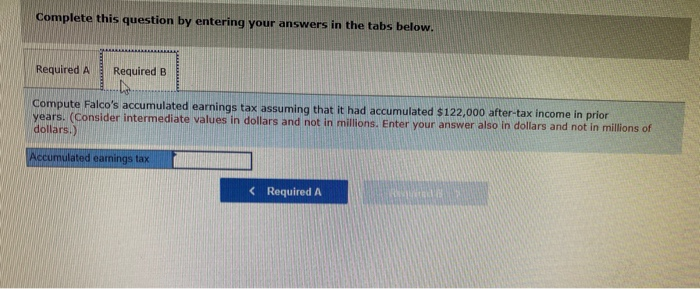

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved Determine Whether The Following Statements About The Chegg Com

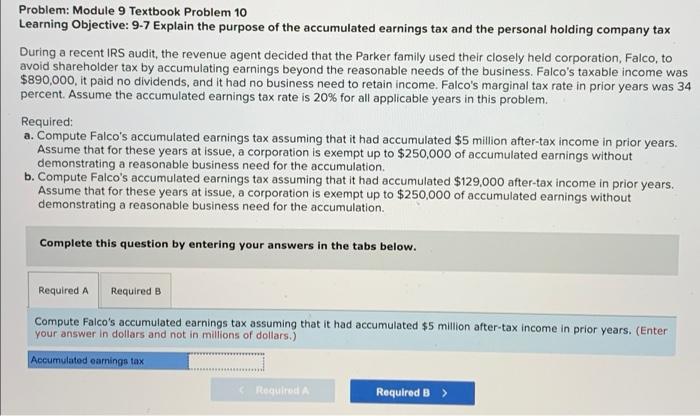

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com