what is a deferred tax provision

Deferred tax is a topic that is consistently tested in Financial Reporting FR and is often tested in further detail in Strategic Business Reporting SBR. It is recorded as a liability or asset in the balance sheet at the year-end.

The deferred tax represents the negative or positive amounts of tax owed by the Company.

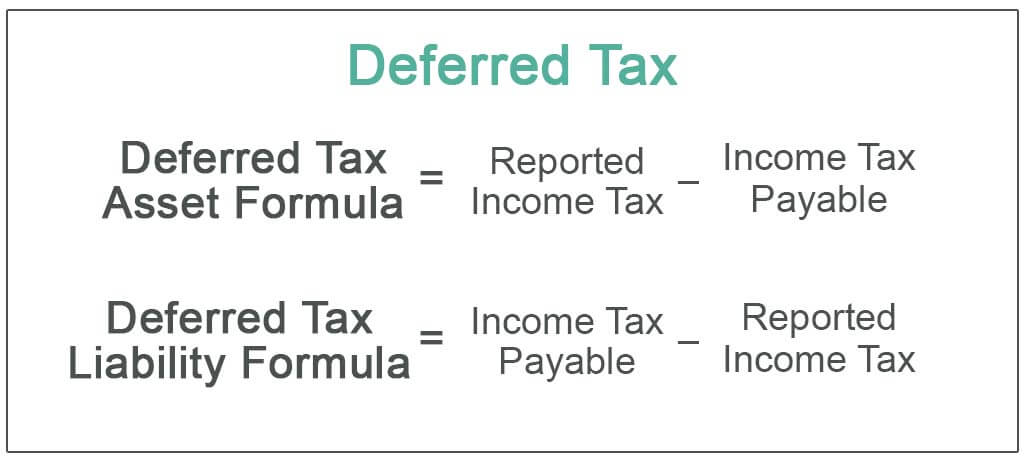

. Deferred tax asset liability is booked in accounts to neutralize those temporarytiming differences arising due to accounting policies followed by the business and the treatments allowed under tax laws. My name is I will be happy to assist youThe deferred tax calculation is basically any difference or carryover that will reduce tax in the future. Deferred income tax expense is the opposite of deferred tax assets.

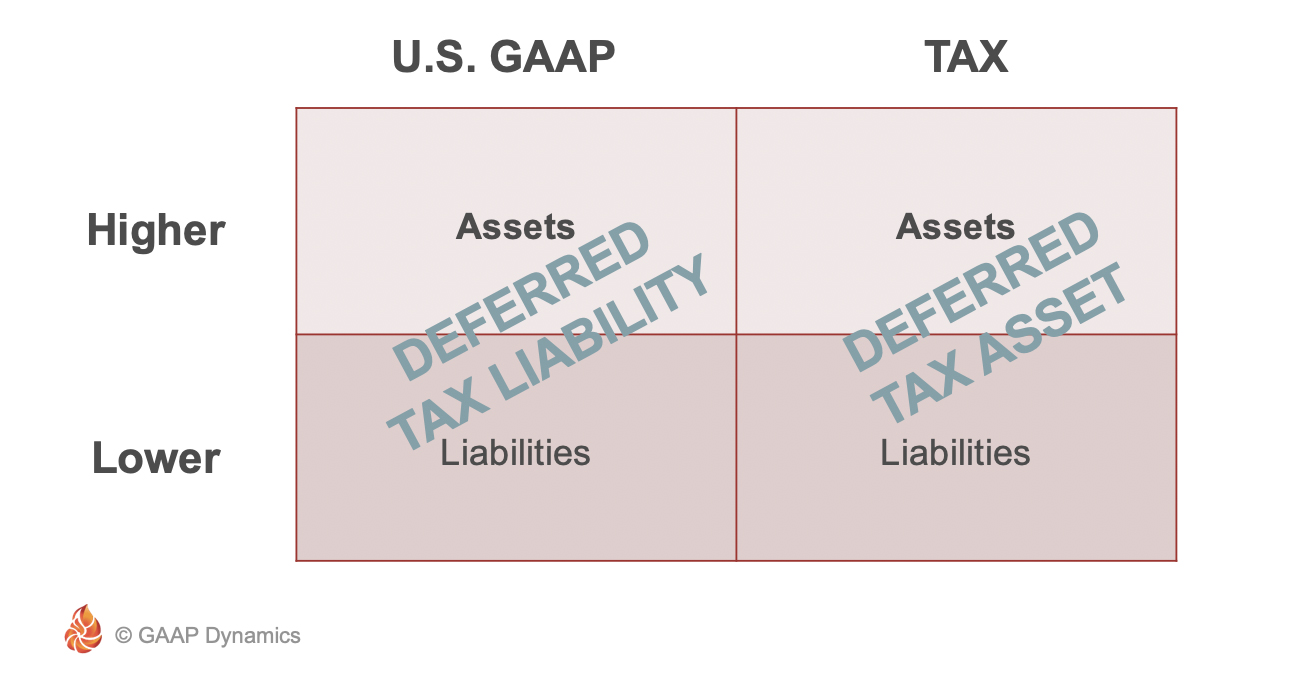

Definition of Deferred Tax. Temporary differences create deferred tax assets or liabilities because their reversal affects future tax expense. It is part of the accounting adjustment and gets eliminated as the temporary differences are reversed over time.

Deferred tax is a topic that is consistently tested in Paper F7 Financial Reporting and is often tested in further detail in Paper P2 Corporate Reporting. However this bad debt is not considered for taxes until it has been written off. Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed.

Another example of Deferred tax assets is Bad Debt. Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years. Usually this results in no net change to the ASC 740 provision for income tax the change in the current tax provision offsets the change in.

Lets look at an example. Lets assume that a company has a book profit of 10000 for a financial year including a provision of 500 as bad debt. A deferred tax liability is an account on a companys balance sheet that is a result of temporary differences between the companys accounting and tax carrying values the.

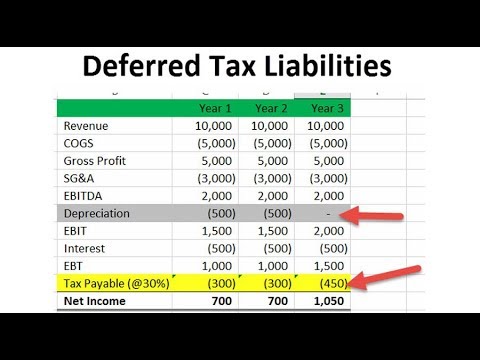

Most companies normally prepare an income statement and a tax statement every. However in its tax statements it has not mentioned that provision due to which their gross profit is Rs. Deferred tax liabilities can arise as a result of corporate taxation treatment of capital expenditure being more rapid than the accounting depreciation treatment.

This more complicated part of the income tax provision calculates a cumulative total of the temporary differences. The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment.

Deferred Tax Liability. A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting methods. Increase the book profit by the amount of deferred tax and its provision or.

Depreciation on fixed assets. This article will start by considering aspects of deferred tax that are relevant to Paper F7 before moving on to the more complicated situations that may be tested in Paper P2. Depending upon nature of temporary differences following two types of deferred tax provision can be recognized.

More specifically we focus on how government support in the form of tax incentives and tax relief might change previous assessments that were made applying IAS 12 Income Taxes IAS 12. Therefore it is creating a deferred tax asset of Rs. In year 1 they buy a computer for 1800 and this is written off in the accounts by way of a.

Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets. A business has profits each year of 5000 before any depreciation charge. Provision on doubtful accounts or debt or warranty.

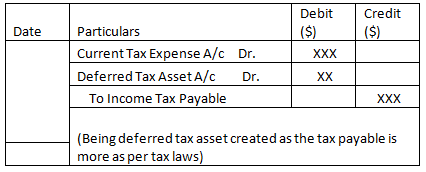

A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities. This article will start by considering aspects of deferred tax that are relevant to FR before moving on to the more complicated situations that may be tested in SBR.

Deferred tax income for current year 5000 5000-0 The company profit before tax is 80000. Thus the Company will have to pay tax on 10500 creating this tax asset. The result is your companys current year tax expense for the income tax provision.

Deferred Income Tax. However it is the profit in accounting base so we have to make adjustment to determine taxable income by adding 20000 as revenues in 2017. Decrease the book profit by the amount of deferred tax if at all such an amount appears on the credit side of the profit and loss account.

A deferred tax often represents the mathematical difference between the book carrying value ie an amount recorded in the accounting balance sheet for an asset or liability and a corresponding tax basis determined under the tax laws of that jurisdiction in the asset or liability multiplied by the applicable jurisdictions statutory. The term deferred tax refers to a tax which shall either be paid in future or has already been settled in advance. This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19.

- Answered by a verified Tax Professional. Deferred tax refers to income tax overpaid or owed due to the temporary differences between accounting income and taxable income. Deferred tax can fall into one of two categories.

In this article we will see why a company may differ its tax to a subsequent fiscal year or why a company may choose to pay the tax in advance. What is and how is a Deferred Tax Provision Calculation done. The deferred income tax expense calculates the sum total of the temporary differences and applies the federal corporate tax rate to the resulting.

Its also a result of the differences in income recognition between income tax accounting rules and your companys accounting. Income Tax Slab Tax Rates for FY 2021-22 AY 2022-23. Deferred tax liabilities and deferred tax assets.

Deferred income taxes impact the future cash flow of the Company ie if its an asset the cash outflow will be less and. Deferred income tax expense.

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Double Entry Bookkeeping

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Meaning Expense Examples Calculation

Deferred Tax Liabilities Meaning Example Causes And More

Deferred Tax Asset Deferred Tax Assets Vs Deferred Tax Liability

Deferred Tax Liabilities India Dictionary

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Deferred Tax Liabilities Meaning Example How To Calculate

Net Operating Losses Deferred Tax Assets Tutorial

What Is A Deferred Tax Liability Community Tax

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)